401k withdrawal tax rate calculator

So if you withdraw the 10000 in your 401 k at age 40 you may get. Using this 401k early withdrawal calculator is easy.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

0 6 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from.

. Contributions to retirement accounts can be made pre-tax as in. Expected Retirement Age This is the age at which you plan to retire. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20.

The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. In this case your withdrawal is subject to the.

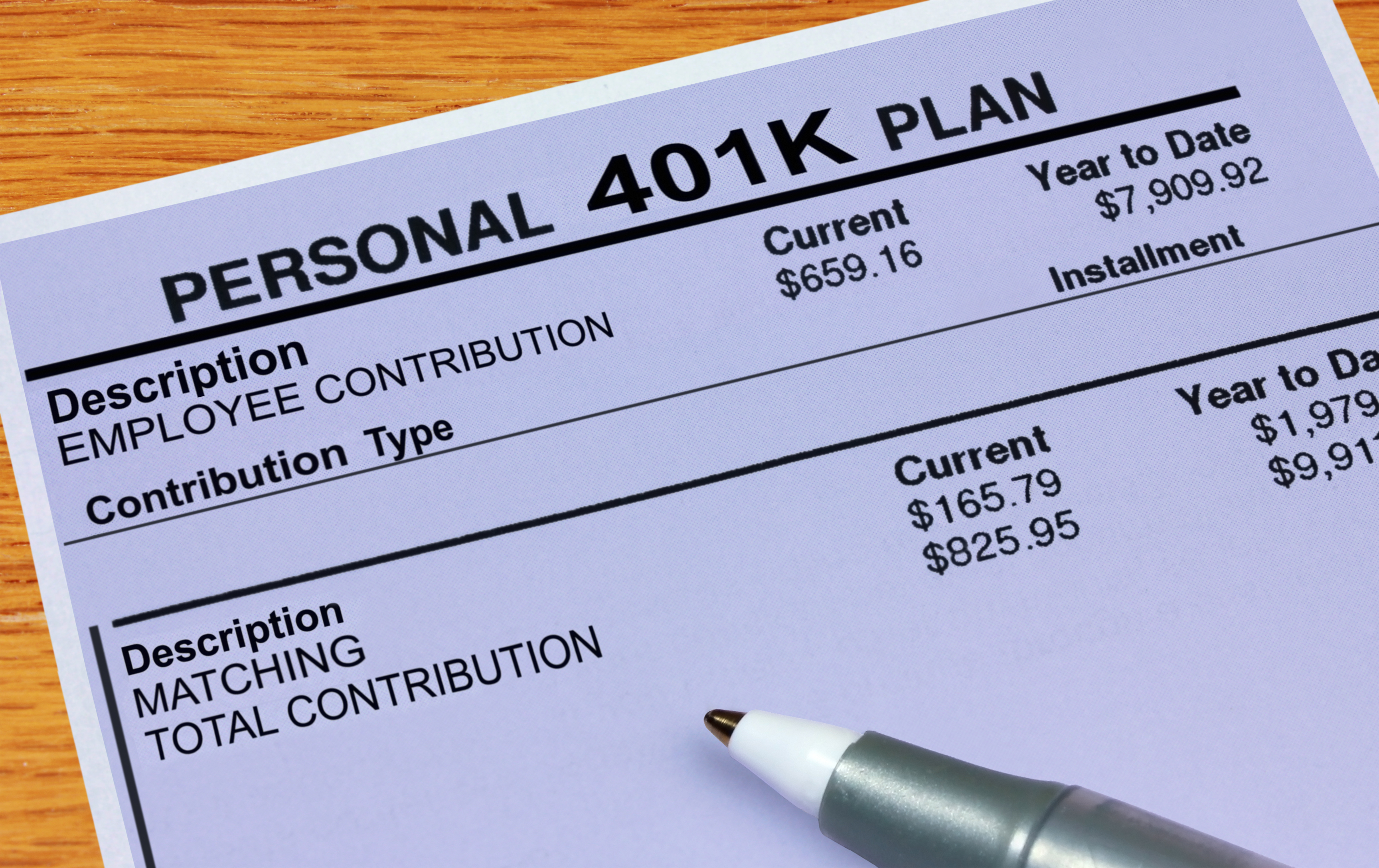

Contributions to a 401k are made pre-tax investments grow tax-deferred and income taxes are paid on withdrawal at the tax rate applicable at the time of withdrawal. Taxes on a Traditional 401 k For the tax year 2021 for example payable on April 18 2022 a married couple who files jointly and earns 90000 together would pay 9328 plus. We have the SARS tax rates tables.

Like the 4 retirement withdrawal rule the safe withdrawal rate model usually leads to a retiree using no more than 3 or 4 of their total available retirement investment. Ad If you have a 500000 portfolio download your free copy of this guide now. Early withdrawals from retirement accounts.

0 6 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your qualified. Is it possible to roll over my retirement savings such as my 401k IRA or 403b accounts into an annuity without paying taxes. For example if your state tax rate equals 5 percent multiply 20000 by 005 to find you owe 1000.

This is only true for people within a certain income range as those who have. In 2022 this is 20500 towards a 401 k and 6000 7000 if older than 50 towards a traditional IRA. Calculate your mortgage payment.

Retirement Withdrawal Calculator Terms and Definitions. 401 K Calculator Credit Karma. What should you withdraw.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Amount You Expected to Withdraw This is the budgeted. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made.

State income tax rate. For example if you fall in the. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income.

Multiply the amount of your 401k plan withdrawal by your state income tax rate. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. First all contributions and earnings to your 401 k are tax deferred.

Tax Withholding For Pensions And Social Security Sensible Money

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

What Is The 401 K Tax Rate For Withdrawals Smartasset

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

How Much Is Your 401k Taxed After Retirement 2022

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Traditional Vs Roth Ira Calculator

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Traditional Vs Roth Ira Calculator

401k Calculator

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Who Should Make After Tax 401 K Contributions Smartasset